Since the start of this crisis retail brands of all flavours have been passing key elements of the fiscal pain of this crisis further down the supply chain by offloading committed orders, or worse still refusing to make payments.

For those national chain store retailers supply chain management has become an even bigger critical business imperative.

Before Covid we saw the start of a huge shift in B2B sectors where we saw brands that were once a supplier to the wholesale and retail sector choosing to go direct to the consumer (D2C), and where 90% of those consumers say they are more than happy to deal with them, particularly via social commerce - so, is today's supplier possibly tomorrows competitor?

If, as some suggest the growth in online sales for grocery retailers jumps to circa 20%+ what impact is that going to have on the huge legacy investments in Supermarket real estate?

How do FMCG brands like 'Unilever, P&G, GSK, Philips, GE Healthcare' and others remain front of mind when trying to convince us that they're handwash, soap, health, wellness and beauty products are the best and the most 'innovative' when the consumer increasingly chooses to shop online for the 'convenience?

Here's 3 ways retailers and FMCG brands can at least stay ahead

1. IoT-Driven Visibility

A 2020 study revealed that 51% of supply chains recognise a need for further investment in digital technologies like the IoT. IoT tracking can provide real-time visibility, which retailers need now. This instantly-accessible data can help companies anticipate delays and respond appropriately, mitigating their impact.

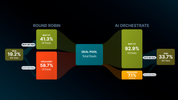

2. AI-Based Optimisation

AI analysis can predict potential delays earlier and more accurately than people, giving retailers time to adjust. Similar programs can also find inefficiencies or vulnerabilities within a supply chain’s operations. Companies can then optimize their workflows, enabling more resilience and faster recovery.

3. Local Sourcing

When stock doesn’t have to travel across borders, retailers can restock or fulfill orders faster and more affordably. While production costs may be higher, the savings from logistics will likely be enough to convince retailers to make the switch to localization. Shorter supply chains will enable more flexibility, helping companies cope with any further disruptions.

I'm pretty sure my network in retail will have many other thoughts and ideas around solving many of these supply chain conundrums?

You only have to consider the multi-levels of distribution that all those car manufacturers, financial services, and other products currently have to go through.

4. Social Media

And the innovative D2C of today's 'go to market' communications strategy just happens to be via the free to access, free to use social media platforms providing access to consumers all around the world.

Amid the pandemic, unconventional business models proved to be some of the most effective. Target’s practice of fulfilling e-commerce orders through its physical stores showed remarkable success. The retailer fulfilled more than 75% of its digital sales in-store, leading to a 30% reduction in digital fulfillment costs.

https://modernretail.co.uk/5-retail-supply-chain-trends-for-2021/

unknownx500

unknownx500