This report, from SBI has some interesting results.

The report details what high growth companies do, so I thought I would strip out some of the fluffy words and give it to you direct.

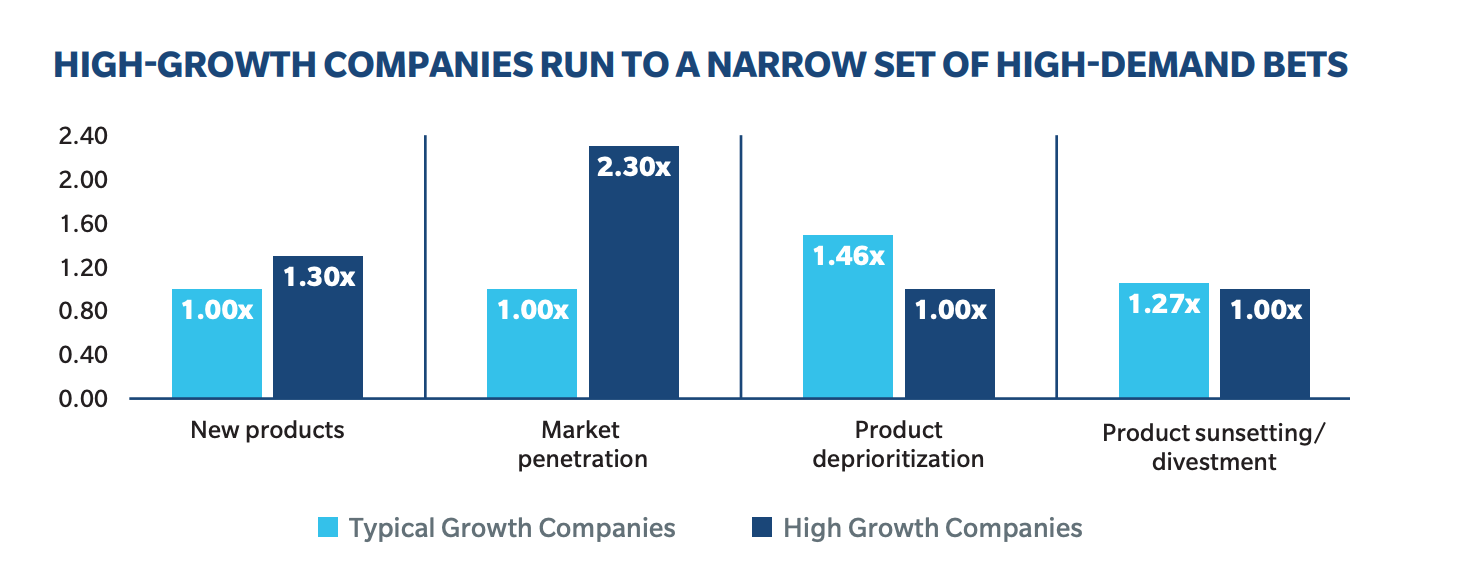

Place your bets

High growth companies, know where to place their bets for 2022.

That doesn't surprise you I'm sure. Next up.

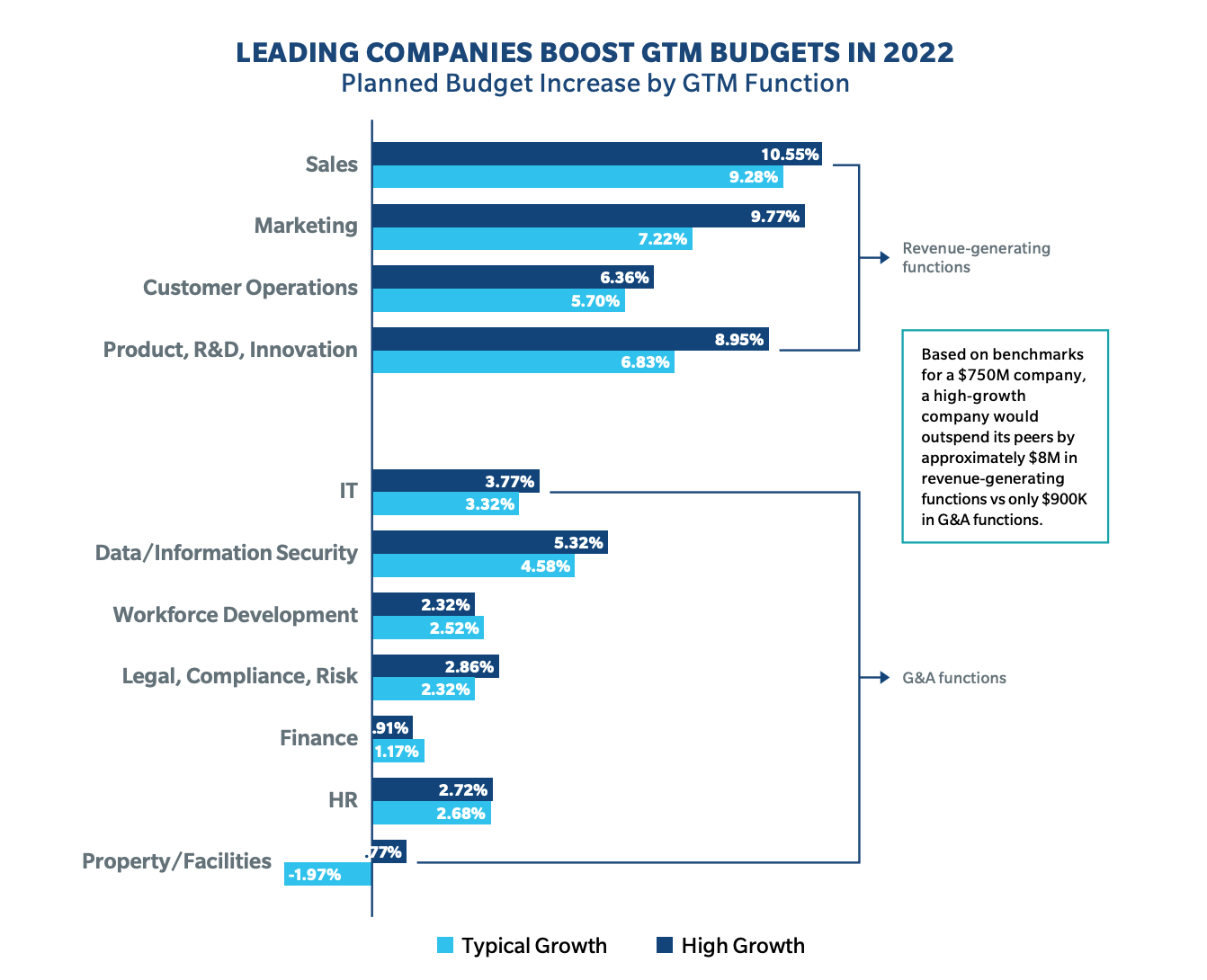

High growth companies invest in sales and marketing

High growth companies are investing in their go-to-market, right across the board, covering; sales, marketing, and revenue operations (RevOps); in fact all parts of the business that is revenue generating.

Which takes us to the next area of focus for high growth companies, which is digital selling, or as some people call it, social selling. What's interesting is that high growth companies are doubling down on social selling.

High growth companies are double down on social selling

To quote the report

"Emphasis on .... Digital Selling: With buyers who aspire to navigate a purchase as independently as possible, and in-person events a distant memory, winning companies recognize the need to make permanent changes to their GTM approach. Dedicated resourcing for digital ... selling enables targeted demand creation at the top of the funnel and accelerates lead progress ... that make it easy for buyers to gather information and interact with products. If executed well, these interactions can also support seller productivity..."

This article goes onto state..

"CEOs are increasing sales and marketing investment more than any other functional area in 2022, and most GTM leaders are funneling a significant portion of that investment to quota-carrying reps."

They then go onto say that the number one area that high growth companies are investing in is digital selling / social selling.

But why?

But why?

"Digital selling and enablement investments can support greater productivity from both new and existing hires by shifting capacity to digital channels and delivering a superior buying experience from your customers’ point of view. Commercial leaders should audit their companies’ buying journeys and encourage their teams to double down in digital selling tactics to accelerate results in 2022"

Literally, this report tells you to double down on digital selling.

Conclusion

High performance companies are doubling down on digital / social selling and increasing social selling spend by 69%!

So who's social selling?

In case you missed it, the Bank of America’s Merrill Lynch have banned cold calling and have moved all their people to social selling. This isn't some trendy tech company that might have decided to do this on a whim, this is a very conservative financial services company that has made a decision based on data.

But surely cold calling has a better ROI than social selling? Not according to Merrill Lynch.

"They will also be encouraged to contact prospects over LinkedIn, which has a higher hit rate than cold calling"

The CRO (chief revenue officer), Richard Eltham of Namos Solutions, of one of clients posted a comment on LinkedIn about social selling. See here.

“Social selling is not an option now it is the way of the world and you either learn and execute it or fear getting left behind”

Kevin Murray who is the Head of Sales at MacArtney Underwater Technology recently posted about his success with social selling here and wrote an article about the transformation that has happened in sales here.

I don't believe you Tim!

If you check out this video of Chris Mason CEO at Oracle reseller Namos, fast forward to 19 minutes 55 seconds. Chris talks about a $2.6 million win from being on social, after completing the DLA Ignite social selling and influence course.

Here at DLA Ignite we don't do "hints and tips sessions" we don't want you to waste your money. Our social selling and influence methodology will provide your sales team with the stable platform for growth. It is also the only social selling program based on 70:20:10 change management principles which gives your business the mindset change and habit change they need in this digital world.

unknownx500

unknownx500